Debunking Long-Only Commodity Investing

Dr Mauritz van den Worm, PhD

18 July, 2019

Overview

Rough Outline

- Introduce the BCOM Index as long-only proxy

- Define backwardation and contango

- Curve impact of roll ajusted price series

- Reconstruct long-only Index

- Performance attribution during backwardation and contango

- Improving the long-only Index

- Alternative strategies

- Polar Star Diversified Portfolio

BCOM Index

BCOM Evolution

BCOM Weights

Aggregated Weights

Curve Shape

Contango

Backwardation

The effect of roll yield - Corn

The effect of roll yield - Natural Gas

The effect of roll yield - Chicago Wheat

The effect of roll yield - Arabica Coffee

Index Proxy

Index Proxy vs BCOM

Index Proxy - Risk and Return Statistics

| Risk/Reward Statistics | |

|---|---|

| Sharpe Ratio | 0.09 |

| Sortino Ratio | 0.13 |

| Omega Ratio | 0.13 |

| Skewness | -0.53 |

| Kurtosis | 3.03 |

| Risk Statistics | |

|---|---|

| Annualized Std.Deviation | 13.08 |

| Maximum Drawdown | 57.29 |

| Month to Recover | 134.00 |

| Worst Month | -20.78 |

| Losing Months (%) | 46.20 |

| Average Losing Month | -2.84 |

| Loss Deviation | 2.76 |

| Return Statistics | |

|---|---|

| Last Month | -0.77 |

| Year To Date | 3.40 |

| 3 Month ROR | -1.08 |

| 12 Month ROR | -5.58 |

| 36 Month ROR | -3.22 |

| Total Return | 41.15 |

| Compound ROR | 1.22 |

| Best Month | 12.64 |

| Winning Months (%) | 53.80 |

Index Proxy - Time Windown Report

Time Window Analysis:

| 1 Month | 3 Month | 6 Month | 1 Year | 2 Year | 3 Year | 5 Year | |

|---|---|---|---|---|---|---|---|

| Best | 12.64 | 21.98 | 32.33 | 40.84 | 67.44 | 87.54 | 144.48 |

| Worst | -20.78 | -34.36 | -45.42 | -45.36 | -39.97 | -43.18 | -48.08 |

| Average | 0.17 | 0.56 | 1.28 | 2.71 | 5.89 | 8.75 | 16.81 |

| Median | 0.26 | 0.70 | 2.57 | 2.51 | 2.94 | 3.44 | 8.96 |

| Last | -0.77 | -1.08 | -1.91 | -5.58 | -4.16 | -3.22 | -33.33 |

| Winning (%) | 53.80 | 56.18 | 59.94 | 58.01 | 56.11 | 54.07 | 62.54 |

| Avg. Pos. Period | 2.76 | 5.15 | 8.02 | 13.55 | 23.18 | 29.86 | 40.47 |

| Avg. Neg. Period | -2.84 | -5.32 | -8.81 | -12.27 | -16.22 | -16.10 | -22.71 |

| # Of Periods | 342.00 | 340.00 | 337.00 | 331.00 | 319.00 | 307.00 | 283.00 |

Drawdown Report:

| Depth (%) | Length (Months) | Recovery (Months) | Start | End |

|---|---|---|---|---|

| -57.29 | 134 | NA | 2008-07-31 | NA |

| -36.93 | 77 | 56 | 1997-06-30 | 2003-10-31 |

| -9.54 | 14 | 12 | 2006-08-31 | 2007-09-28 |

| -8.10 | 31 | 16 | 1991-11-29 | 1994-05-31 |

| -6.02 | 4 | 3 | 2008-03-31 | 2008-06-30 |

Index Proxy Performance Attribution - WTI Crude Oil

Index Proxy Performance Attribution - Arabic Coffee

Index Proxy Performance Attribution - Corn

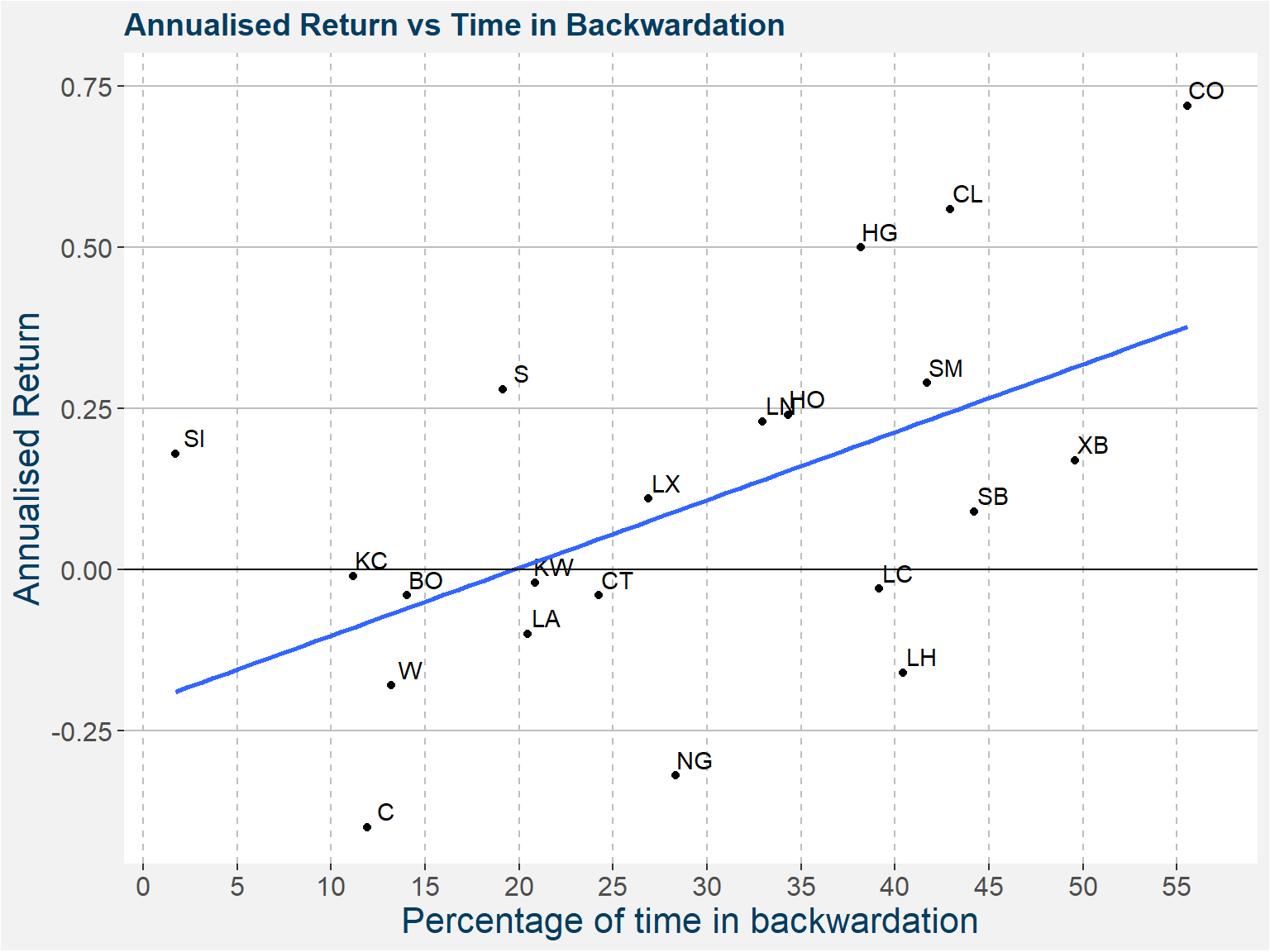

Curve Shape and Annualised Return

Long Backwardated Commodities

Basic Idea

- Only take long exposure in those commodities whose curves are in backwardation

- Define the spread

\[ S_{C,K} := P_{C,K} - P_{C,K'} \]

for each commodity \(C\) as the price difference between the front contract \(K\) and deferred contract, twelve months out from the front contract, \(K'\).

- If \(S_{C,K}\) < 0 the curve is in contango

- If \(S_{C,K}\) > 0 the curve is in backwardation

Long Backwardated - Equity Curve

Long Backwardated Commodities - Risk and Return Statistics

| Risk/Reward Statistics | |

|---|---|

| Sharpe Ratio | 0.48 |

| Sortino Ratio | 0.72 |

| Omega Ratio | 0.57 |

| Skewness | 0.51 |

| Kurtosis | 4.74 |

| Risk Statistics | |

|---|---|

| Annualized Std.Deviation | 8.72 |

| Maximum Drawdown | 20.20 |

| Month to Recover | 100.00 |

| Worst Month | -10.50 |

| Losing Months (%) | 47.08 |

| Average Losing Month | -1.39 |

| Loss Deviation | 1.69 |

| Return Statistics | |

|---|---|

| Last Month | 0.07 |

| Year To Date | -3.61 |

| 3 Month ROR | -3.43 |

| 12 Month ROR | -5.86 |

| 36 Month ROR | -2.96 |

| Total Return | 223.44 |

| Compound ROR | 4.20 |

| Best Month | 13.93 |

| Winning Months (%) | 51.75 |

Long Backwardated Commodities - Time Windown Report

Time Window Analysis:

| 1 Month | 3 Month | 6 Month | 1 Year | 2 Year | 3 Year | 5 Year | |

|---|---|---|---|---|---|---|---|

| Best | 13.93 | 18.75 | 25.14 | 42.06 | 57.59 | 73.49 | 121.12 |

| Worst | -10.50 | -15.53 | -16.51 | -17.10 | -16.34 | -14.78 | -17.76 |

| Average | 0.38 | 1.13 | 2.35 | 5.00 | 10.94 | 17.33 | 34.24 |

| Median | 0.04 | 0.56 | 1.23 | 2.54 | 4.90 | 12.46 | 28.58 |

| Last | 0.07 | -3.43 | -3.34 | -5.86 | -1.63 | -2.96 | -14.04 |

| Winning (%) | 51.75 | 56.76 | 60.24 | 60.42 | 66.77 | 73.94 | 80.92 |

| Avg. Pos. Period | 1.99 | 3.93 | 6.38 | 11.59 | 19.11 | 25.17 | 44.21 |

| Avg. Neg. Period | -1.39 | -2.55 | -3.75 | -5.05 | -5.49 | -4.91 | -8.07 |

| # Of Periods | 342.00 | 340.00 | 337.00 | 331.00 | 319.00 | 307.00 | 283.00 |

Drawdown Report:

| Depth (%) | Length (Months) | Recovery (Months) | Start | End |

|---|---|---|---|---|

| -20.20 | 100 | NA | 2011-05-31 | NA |

| -17.60 | 27 | 12 | 2000-12-29 | 2003-02-28 |

| -16.80 | 34 | 26 | 2008-07-31 | 2011-04-29 |

| -16.75 | 33 | 11 | 1997-06-30 | 2000-02-29 |

| -9.12 | 50 | 26 | 1991-11-29 | 1995-12-29 |

Short Contango Commodities

Short Contango Commodities - Equity Curve

Short Contango Commodities - Risk and Return Statistics

| Risk/Reward Statistics | |

|---|---|

| Sharpe Ratio | 0.12 |

| Sortino Ratio | 0.19 |

| Omega Ratio | 0.16 |

| Skewness | 0.91 |

| Kurtosis | 5.54 |

| Risk Statistics | |

|---|---|

| Annualized Std.Deviation | 12.38 |

| Maximum Drawdown | 41.95 |

| Month to Recover | 85.00 |

| Worst Month | -12.25 |

| Losing Months (%) | 49.42 |

| Average Losing Month | -2.31 |

| Loss Deviation | 2.19 |

| Return Statistics | |

|---|---|

| Last Month | -0.70 |

| Year To Date | -9.84 |

| 3 Month ROR | -4.80 |

| 12 Month ROR | -2.18 |

| 36 Month ROR | -3.85 |

| Total Return | 49.85 |

| Compound ROR | 1.43 |

| Best Month | 22.36 |

| Winning Months (%) | 50.58 |

Short Contango Commodities - Time Windown Report

Time Window Analysis:

| 1 Month | 3 Month | 6 Month | 1 Year | 2 Year | 3 Year | 5 Year | |

|---|---|---|---|---|---|---|---|

| Best | 22.36 | 44.63 | 62.51 | 72.54 | 63.91 | 67.30 | 76.54 |

| Worst | -12.25 | -17.07 | -18.41 | -22.06 | -31.63 | -32.03 | -31.85 |

| Average | 0.18 | 0.58 | 1.29 | 2.64 | 5.00 | 7.67 | 13.22 |

| Median | 0.03 | -0.15 | -0.72 | -0.81 | 0.06 | 2.16 | 9.64 |

| Last | -0.70 | -4.80 | -4.56 | -2.18 | 1.08 | -3.85 | 34.03 |

| Winning (%) | 50.58 | 48.82 | 45.40 | 45.62 | 50.16 | 55.05 | 62.54 |

| Avg. Pos. Period | 2.61 | 5.19 | 9.21 | 14.37 | 19.64 | 22.99 | 29.97 |

| Avg. Neg. Period | -2.31 | -3.81 | -5.30 | -7.20 | -9.73 | -11.10 | -14.74 |

| # Of Periods | 342.00 | 340.00 | 337.00 | 331.00 | 319.00 | 307.00 | 283.00 |

Drawdown Report:

| Depth (%) | Length (Months) | Recovery (Months) | Start | End |

|---|---|---|---|---|

| -41.95 | 85 | 12 | 2002-02-28 | 2009-02-27 |

| -35.56 | 81 | 51 | 2009-03-31 | 2015-11-30 |

| -18.40 | 42 | NA | 2016-03-31 | NA |

| -17.64 | 30 | 19 | 1999-03-31 | 2001-08-31 |

| -14.77 | 79 | 49 | 1992-01-31 | 1998-07-31 |

Combination Portfolio

Basic Idea

Here we combine the two ideas

- Take long exposure in backwardated commodities

- Take short exposure in contango commodities

- Keep the BCOM Index weights

Combination Portfolio - Equity Curve

Combination Portfolio - Risk and Return Statistics

| Risk/Reward Statistics | |

|---|---|

| Sharpe Ratio | 0.46 |

| Sortino Ratio | 0.80 |

| Omega Ratio | 0.51 |

| Skewness | 0.77 |

| Kurtosis | 3.92 |

| Risk Statistics | |

|---|---|

| Annualized Std.Deviation | 13.27 |

| Maximum Drawdown | 27.72 |

| Month to Recover | 77.00 |

| Worst Month | -10.65 |

| Losing Months (%) | 43.57 |

| Average Losing Month | -2.53 |

| Loss Deviation | 2.19 |

| Return Statistics | |

|---|---|

| Last Month | -1.58 |

| Year To Date | -14.27 |

| 3 Month ROR | -9.22 |

| 12 Month ROR | -8.76 |

| 36 Month ROR | -7.22 |

| Total Return | 436.09 |

| Compound ROR | 6.07 |

| Best Month | 22.36 |

| Winning Months (%) | 56.43 |

Combination Portfolio - Time Windown Report

Time Window Analysis:

| 1 Month | 3 Month | 6 Month | 1 Year | 2 Year | 3 Year | 5 Year | |

|---|---|---|---|---|---|---|---|

| Best | 22.36 | 41.81 | 56.36 | 65.80 | 68.23 | 94.43 | 144.49 |

| Worst | -10.65 | -13.79 | -17.99 | -18.51 | -19.88 | -24.06 | -19.80 |

| Average | 0.56 | 1.73 | 3.56 | 7.42 | 15.90 | 26.06 | 50.39 |

| Median | 0.33 | 0.99 | 1.82 | 4.67 | 15.75 | 24.46 | 43.23 |

| Last | -1.58 | -9.22 | -8.87 | -8.76 | -1.24 | -7.22 | 16.02 |

| Winning (%) | 56.43 | 56.76 | 60.53 | 65.86 | 77.12 | 82.41 | 93.99 |

| Avg. Pos. Period | 2.95 | 6.07 | 9.06 | 14.34 | 23.43 | 33.73 | 54.20 |

| Avg. Neg. Period | -2.53 | -3.98 | -4.87 | -5.92 | -9.48 | -9.85 | -9.16 |

| # Of Periods | 342.00 | 340.00 | 337.00 | 331.00 | 319.00 | 307.00 | 283.00 |

Drawdown Report:

| Depth (%) | Length (Months) | Recovery (Months) | Start | End |

|---|---|---|---|---|

| -27.72 | 77 | 32 | 2009-03-31 | 2015-07-31 |

| -20.50 | 44 | NA | 2016-01-29 | NA |

| -20.31 | 56 | 25 | 1991-11-29 | 1996-06-28 |

| -14.98 | 24 | 13 | 2002-01-31 | 2003-12-31 |

| -11.56 | 14 | 12 | 2006-10-31 | 2007-11-30 |

Trend System on BCOM Commodities

Basic Idea

- Use the Polar Star Trend System on a universe defined by the BCOM commodities

- Added diversification by adding long and short positions in trending markets

Trend System on BCOM Commodities - Equity Curve

Trend System on BCOM Commodities - Risk and Return Statistics

| Risk/Reward Statistics | |

|---|---|

| Sharpe Ratio | 0.55 |

| Sortino Ratio | 1.23 |

| Omega Ratio | 0.64 |

| Skewness | 0.98 |

| Kurtosis | 2.75 |

| Risk Statistics | |

|---|---|

| Annualized Std.Deviation | 23.44 |

| Maximum Drawdown | 42.13 |

| Month to Recover | 41.00 |

| Worst Month | -12.85 |

| Losing Months (%) | 46.04 |

| Average Losing Month | -4.17 |

| Loss Deviation | 3.02 |

| Return Statistics | |

|---|---|

| Last Month | 0.66 |

| Year To Date | -0.78 |

| 3 Month ROR | 0.82 |

| 12 Month ROR | 13.73 |

| 36 Month ROR | -24.21 |

| Total Return | 3003.21 |

| Compound ROR | 12.85 |

| Best Month | 32.35 |

| Winning Months (%) | 53.96 |

Trend System on BCOM Commodities - Time Windown Report

Time Window Analysis:

| 1 Month | 3 Month | 6 Month | 1 Year | 2 Year | 3 Year | 5 Year | |

|---|---|---|---|---|---|---|---|

| Best | 32.35 | 65.19 | 78.93 | 104.30 | 151.85 | 249.49 | 287.80 |

| Worst | -12.85 | -18.22 | -23.14 | -25.26 | -39.65 | -35.82 | -5.86 |

| Average | 1.23 | 3.69 | 7.58 | 15.62 | 33.31 | 55.17 | 109.09 |

| Median | 0.49 | 2.58 | 5.02 | 11.92 | 29.69 | 49.70 | 79.58 |

| Last | 0.66 | 0.82 | -0.78 | 13.73 | -9.90 | -24.21 | 7.84 |

| Winning (%) | 53.96 | 59.59 | 61.90 | 70.00 | 81.76 | 85.29 | 97.87 |

| Avg. Pos. Period | 5.84 | 10.65 | 17.17 | 26.75 | 44.23 | 67.45 | 111.55 |

| Avg. Neg. Period | -4.17 | -6.58 | -8.01 | -10.35 | -15.64 | -16.02 | -4.18 |

| # Of Periods | 341.00 | 339.00 | 336.00 | 330.00 | 318.00 | 306.00 | 282.00 |

Drawdown Report:

| Depth (%) | Length (Months) | Recovery (Months) | Start | End |

|---|---|---|---|---|

| -42.13 | 41 | NA | 2016-03-31 | NA |

| -28.57 | 29 | 7 | 2001-11-30 | 2004-03-31 |

| -25.79 | 22 | 5 | 2009-03-31 | 2010-12-31 |

| -25.67 | 41 | 20 | 2011-05-31 | 2014-09-30 |

| -25.02 | 22 | 6 | 2004-04-30 | 2006-01-31 |

Trend System on Extended Universe of Commodities

Basic Idea

Use the Polar Star Trend System on an extended universe of commodities

- Diversification added by

- Long and short positions in trending markets

- Extended universe of commodities

- Look at different parts of the curves

Trend System on Extended Universe of Commodities - Equity Curve

Trend System on Extended Universe of Commodities - Risk and Return Statistics

| Risk/Reward Statistics | |

|---|---|

| Sharpe Ratio | 0.82 |

| Sortino Ratio | 1.95 |

| Omega Ratio | 1.03 |

| Skewness | 1.53 |

| Kurtosis | 7.20 |

| Risk Statistics | |

|---|---|

| Annualized Std.Deviation | 21.68 |

| Maximum Drawdown | 41.79 |

| Month to Recover | 47.00 |

| Worst Month | -11.32 |

| Losing Months (%) | 43.11 |

| Average Losing Month | -3.48 |

| Loss Deviation | 2.62 |

| Return Statistics | |

|---|---|

| Last Month | 0.59 |

| Year To Date | 3.16 |

| 3 Month ROR | 5.23 |

| 12 Month ROR | 19.71 |

| 36 Month ROR | 1.18 |

| Total Return | 10227.97 |

| Compound ROR | 17.73 |

| Best Month | 44.08 |

| Winning Months (%) | 56.89 |

Trend System on Extended Universe of Commodities - Time Windown Report

Time Window Analysis:

| 1 Month | 3 Month | 6 Month | 1 Year | 2 Year | 3 Year | 5 Year | |

|---|---|---|---|---|---|---|---|

| Best | 44.08 | 84.24 | 116.12 | 165.97 | 272.37 | 367.65 | 469.46 |

| Worst | -11.32 | -15.25 | -26.58 | -28.72 | -35.94 | -37.96 | -19.35 |

| Average | 1.55 | 4.79 | 9.96 | 21.13 | 46.60 | 77.05 | 155.78 |

| Median | 1.08 | 3.58 | 7.85 | 17.71 | 39.30 | 64.06 | 147.07 |

| Last | 0.59 | 5.23 | 3.16 | 19.71 | 10.30 | 1.18 | 44.71 |

| Winning (%) | 56.89 | 64.31 | 69.05 | 74.24 | 84.28 | 87.91 | 97.16 |

| Avg. Pos. Period | 5.37 | 10.59 | 17.90 | 31.87 | 58.18 | 90.04 | 160.69 |

| Avg. Neg. Period | -3.48 | -5.68 | -7.78 | -9.83 | -15.49 | -17.39 | -12.35 |

| # Of Periods | 341.00 | 339.00 | 336.00 | 330.00 | 318.00 | 306.00 | 282.00 |

Drawdown Report:

| Depth (%) | Length (Months) | Recovery (Months) | Start | End |

|---|---|---|---|---|

| -41.79 | 47 | 14 | 2011-03-31 | 2015-01-30 |

| -28.64 | 46 | NA | 2015-10-30 | NA |

| -26.48 | 18 | 6 | 2004-08-31 | 2006-01-31 |

| -19.32 | 20 | 2 | 2009-03-31 | 2010-10-29 |

| -15.87 | 7 | 3 | 1993-06-30 | 1993-12-31 |

Polar Star Diversified Commodity Fund

Polar Star Diversified Construction

- Allocate to the three underlying USD funds

- Polar Star Limited

- Polar Star Spectrum

- Polar Star Quantitative

- Weights determined using

- Bootstrapping procedure

- Determine baseline weightings

- Black-Litterman

- Add PM views

- Rebalance quarterly

Polar Star Diversified Commodity Fund - Equity Curve

Polar Star Diversified Commodity Fund - Risk and Return Statistics

| Risk/Reward Statistics | |

|---|---|

| Sharpe Ratio | 1.25 |

| Sortino Ratio | 2.51 |

| Omega Ratio | 1.48 |

| Skewness | 0.17 |

| Kurtosis | 0.17 |

| Risk Statistics | |

|---|---|

| Annualized Std.Deviation | 9.59 |

| Maximum Drawdown | 7.81 |

| Month to Recover | 10.00 |

| Worst Month | -5.31 |

| Losing Months (%) | 36.46 |

| Average Losing Month | -1.83 |

| Loss Deviation | 1.38 |

| Return Statistics | |

|---|---|

| Last Month | -3.01 |

| Year To Date | 4.43 |

| 3 Month ROR | 4.61 |

| 12 Month ROR | 10.65 |

| 36 Month ROR | 18.99 |

| Total Return | 147.97 |

| Compound ROR | 12.02 |

| Best Month | 8.36 |

| Winning Months (%) | 63.54 |

Polar Star Diversified Commodity Fund - Time Windown Report

Time Window Analysis:

| 1 Month | 3 Month | 6 Month | 1 Year | 2 Year | 3 Year | 5 Year | |

|---|---|---|---|---|---|---|---|

| Best | 8.36 | 14.51 | 24.90 | 44.81 | 63.59 | 72.43 | 109.77 |

| Worst | -5.31 | -6.14 | -6.11 | -2.61 | -2.90 | 9.58 | 62.27 |

| Average | 0.99 | 3.03 | 6.06 | 12.12 | 26.17 | 43.34 | 79.41 |

| Median | 0.86 | 2.59 | 4.83 | 9.71 | 22.53 | 47.51 | 76.16 |

| Last | -3.01 | 4.61 | 4.43 | 10.65 | 22.18 | 18.99 | 67.34 |

| Winning (%) | 63.54 | 76.60 | 85.71 | 92.94 | 98.63 | 100.00 | 100.00 |

| Avg. Pos. Period | 2.60 | 4.75 | 7.58 | 13.13 | 26.57 | 43.34 | 79.41 |

| Avg. Neg. Period | -1.83 | -2.60 | -3.04 | -1.14 | -2.90 | NaN | NaN |

| # Of Periods | 96.00 | 94.00 | 91.00 | 85.00 | 73.00 | 61.00 | 37.00 |

Drawdown Report:

| Depth (%) | Length (Months) | Recovery (Months) | Start | End |

|---|---|---|---|---|

| -7.81 | 10 | 2 | 2016-10-31 | 2017-07-31 |

| -6.14 | 5 | 2 | 2014-01-31 | 2014-05-31 |

| -5.79 | 7 | 3 | 2015-12-31 | 2016-06-30 |

| -5.31 | 4 | 3 | 2013-01-31 | 2013-04-30 |

| -5.12 | 3 | 2 | 2013-08-31 | 2013-10-31 |

Bootstrapping Procedure - Outline

Bootstrapping Procedure - Benchmark Weights

Black-Litterman Overview

- Bayesian approach to portfolio construction (video with good insights)

- We use Idzorek’s extension

- Add PM view and confidence to tilt allocation towards

- funds with higher expected returns, and

- funds with greater confidence

Black-Litterman Baseline

| Limited | Quant | Spectrum | |

|---|---|---|---|

| count | 64.00 | 59.00 | 35.00 |

| mean | 3.85 | 3.26 | 4.58 |

| std | 2.96 | 2.61 | 4.02 |

| min | 0.23 | 0.04 | 0.15 |

| 25% | 1.61 | 1.41 | 1.61 |

| 50% | 3.37 | 2.54 | 2.94 |

| 75% | 5.71 | 4.76 | 7.11 |

| max | 11.77 | 9.61 | 14.74 |

| number of months | 107.00 | 107.00 | 58.00 |

| Positve Percentage | 59.81 | 55.14 | 60.34 |

| Equilibrium Weight | 38.50 | 35.50 | 26.00 |

Black-Litterman Tilt

Summary

Long-Only in a nutshell

- The curve shape dominates the returns from commodities

- Lony-only commodities only work in backwardated markets

- Better risk adjusted returns can be achieved by

- adding short positions

- extending the investible universe

- adding risk management

Polar Star Diversified as an alternative

- Exposure to three funds with diversification accross

- Return streams

- Strategies

- Commodities

- Outperforms long-only on absolute and risk adjusted basis

- Dedicated commodities reseach and execution team

- 93+ Years worth of commodity trading experience